Why Musical Artists Are Selling Their Catalog Rights

Why are so many artists selling their music catalogs these days?

It’s become a major story in the music industry during the past couple of years, to the point where the biggest music buyers these days are not fans but rather companies acquiring artist catalogs — especially ownership of songwriting and publishing rights in order to profit from opportunities in a still-expanding media world where music content is gold. Thomas Scherer, president of Repertoire & Marketing for BMG, one of the top buyers in the market, tells Loudwire it's "kind of a gold rush mentality. It started with the big (names) and then all of a sudden everyone else is thinking, 'Maybe I should sell as well' and deals are being made all the time."

The names are indeed big (Bob Dylan, Bruce Springsteen, Motley Crue, Sting, Red Hot Chili Peppers and many more) and the stakes are huge; many of these deals have been quoted (but not necessarily verified) in the eight- and nine-figure range, up to a reported $400 million dollars in Dylan's case. Barely a week goes by without at least one major acquisition announcement, always with a substantial number of zeroes in the mix.

"If you have something that's hot, everybody wants to get in on it," says Cynthia Katz of the law firm Fox Rothschild, which has negotiated nearly $1 billion worth of deals, including Motley Crue's sale to BMG. "All of those things coming together has led to a flourishing new market, a new revenue source for artists that I think is wonderful. You have increasing completion. That increases the prices and creates bidding wars and all of that, and you have a lot of people jumping on these opportunities."

Peter Frampton has not yet sold, but he says bidders are knocking on his door — "at this very moment, actually. Obviously I'm not in the same position as a Bob Dylan or Bruce Springsteen or Sting or anything, but with the amount of money we're talking about it's definitely something that's worth thinking about."

What's been going on here? Suffice to say a confluence of benefits for all concerned parties that's made catalog selling one of the biggest perpetual music stories of the past couple of years...

Why Sell?

One word, of course — money.

Think about it in Powerball or Mega Millions terms; musicians, who once intensely coveted ownership of their songs and recordings (though record companies own the bulk of those) have a choice. They can hold on to their artistic intellectual property and receive an uncertain annuity — based on the vagaries of sales and popularity — or they can cash in for a windfall and do what they wish with the money. It really is that simple.

There are tax benefits as well. Many performers make enough each year to be in the highest income tax bracket, around 37 percent, while a one-time payout is taxed at 20 percent — though that was raised in recent legislation passed by congress. Nevertheless, it can still be more advantageous to take a big-money sure-thing than gamble on the volatility of the marketplace.

Money is also an easier asset to pass along to one's heirs than a song catalog. Some children will understand the business of their parents' music more than others, but if the catalog is sold that diminishes the chance of fighting over what to do with it if it's inherited — especially if it's passed on to multiple recipients. "This is a really good estate planning tool," says attorney Katz. "They can set something up rather than having a bunch of different heirs receiving random royalty checks from different payers and have that all be subject to various taxes. It's a really smart thing to do as some of these artists are getting older."

Simple Minds frontman Jim Kerr, who's 63 and has sold to BMG, concurs. "We've got a lot of people around us," he explains. "I could hold on another 20 years but, y'know, people need money now — the kids, the nephews, the nieces, so on. (Selling) lets us do that without having them fighting about it."

Adds Pink Floyd drummer Nick Mason, "With the recognition of mortality...if we do sell the catalog it might in many ways be an easier way of dealing with one's (estate). I want the money eventually to go to my children. It's a lot easier to (leave money) than leaving what would be maybe 20 people arguing over how to develop the catalog."

What They're Selling

There is no one size fits all way of packaging and selling music.

Some artists sell everything — the proverbial lock, stock and barrel — and walk away with the big check. Others sell a portion of their holdings or a percentage of their catalog and become partners with the buyers, with some continuing say in the future of the music and how it's used. The latter allows them to mix and match the benefits — getting a lump sum but also still having skin in the game, as it were, and some continuing say in how their music is used.

Who's buying?

Financial analysts have warmed up to music as a steady, reliable and appreciating asset — which has brought Wall Street to the table in addition to the existing music conglomerates. "You have these Goldman Sachs reports that are very bullish on the music industry growth," BMG's Scherer explains. "It's double-digit growth they have in their analyses...Therefore it's almost a safe opportunity to invest in these assets and score that (profit) on their investments."

These buyers see music as holding its value and potentially increasing as a proliferation of avenues — broadcast, streaming and otherwise — has created a need for content. That creates more opportunities to monetize the music, with no end in sight. As Journey's Jonathan Cain puts it, "Music is certain, even in uncertain times."

The music industry is still investing in itself, mind you.

BMG, Sony, Universal, the Concord Music Group, Primary Wave, Kobalt Music Copyrights and others are all at the table making acquisitions. Among the more aggressive has been Hipgnosis Songs Fund, a publicly traded (on the London Stock Exchange) Intellectual Property and song management company started in 2018 by music executive Merck Mercuriadis and Rock and Roll Hall of Famer Nile Rodgers; while racking up a portfolio of more than 70 artists and more than 70,000 songs, Hipgnosis last year partnered with the Blackstone Group investment company, injection another $1 billion to continue acquiring catalogs.

The positive prognosis — and results — has brought other banking, investment and equity funds into the music realm, including buyers such as BlackRock, Vine Alternative Investments, Shamrock Capital, Eldridge, KKR and more.

"The people who are looking to buy these (music) assets have grown astronomically," says Fox Rothschild’s Katz. "Even five years ago it was limited to the music industry itself. As technology advances we're able to run models and profile and predict future earnings much better, and Wall Street started paying attention and looking at (music) as an asset class they would invest in along with real estate and everything else in their portfolio. And (music) seems to weather (economic) storms better than a lot of these other holdings, so it became that much more attractive."

How Are They Using It?

Buyers get their return on investment from continuing royalty streams and by licensing the music for use in films, TV shows, advertising campaigns, Internet programming, etc. Wendy Dio, Ronnie James Dio’s widow and manager, sold his rights to Round Hill Music three years ago and laughs as she notes that she and her partners had to pay the company to use his music in the recent documentary Dreamers Never Die.

Who's sold so far?

David Bowie created the mold from 1997-2007, when he struck a $55 million deal with Prudential Insurance Company of America for so-called "Bowie Bonds" based on royalties from 25 albums and 287 songs.

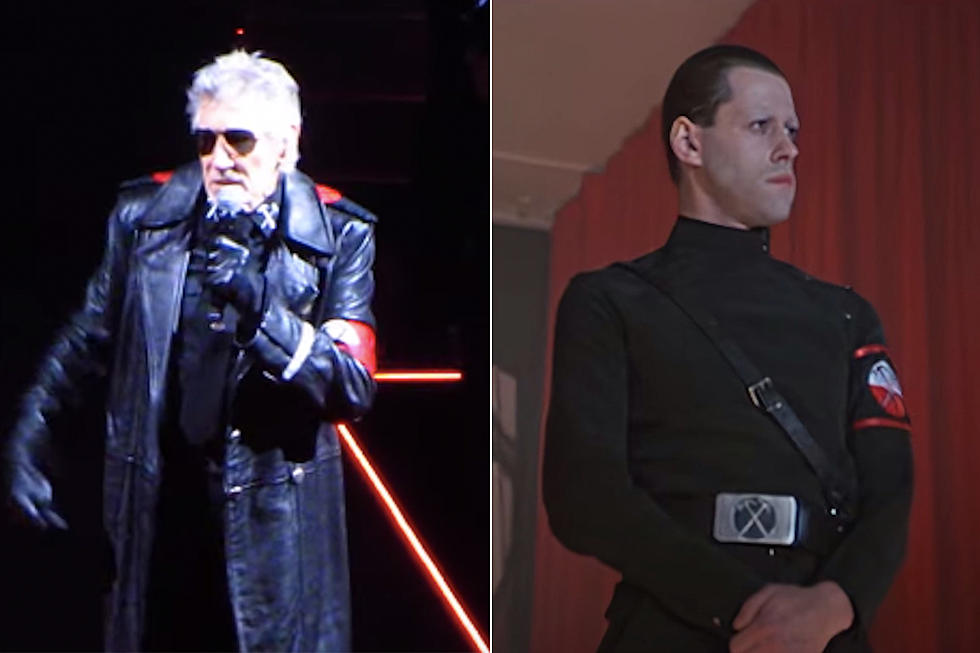

An incomplete list of top name artists who have sold more recently includes Bob Dylan, Bruce Springsteen, Bob Marley, Motley Crue and Nikki Sixx, John Lennon, Paul Simon, Genesis and Phil Collins, Red Hot Chili Peppers, Sting, Twisted Sister's Dee Snider, individual members of Fleetwood Mac, Journey, Ray Charles, Huey Lewis & the News, Dio, Joey Ramone, Neil Young, David Crosby, Richie Sambora, Blondie, Simple Minds, Shakir, Whitney Houston, Rick James and Barry Manilow.

Many sales, of course, are kept secret or at least under the radar, as artists don't want to be seen as selling out.

It's not just limited to older, heritage artists, either. Comparative "youngsters" ranging from Five Finger Death Punch, Imagine Dragons, Justin Timberlake, The Killers, the Chainsmokers, Sum 41's Deryck Whibley, blink-182’s Tom DeLonge, Julian Casablancas of the Strokes, EDM heroes Skrillex and Calvin Harris, and rappers such as 50 Cent and Nelly, and super-writer/producers Mark Ronson, Jack Antonoff, Ryan Tedder, Sam Hollander, Sean Garett, Poo Bear and the D-ream have thrown in with the boom market.

Taylor Swift's early-career rights, meanwhile, were also sold to Shamrock Capital, not by her but by Scooter Braun after he acquired them when he purchased Big Machine Records during 2019.

"It doesn't have to be for older artists only," attorney Katz notes. "As these deals are getting more and more common and prolific, we're looking at new ways to do them that make sense for somebody who's younger and even still in the building phases of their careers."

Who's holding out?

Not everybody is interested in cashing in. Among those is Alice Cooper, who has so far turned down inquiries about his catalog at the advice of manager Shep Gordon. "Shep is one of those guys that says, 'Is it gonna change your lifestyle?' I go, 'No,'" Cooper explains. "And he goes, 'Then why would you ever sell it? It's not gonna change anything. Hold on to it forever. Give it to your kids. The amount of money is just ridiculous, but if I don't have to do it I'd rather keep it."

Pink Floyd was rumored to be on the verge of a catalog sale for estimates of $500 million dollars. But Britain's financial times reported that "infighting" about the terms has caused a delay. And that seems to have caused drummer Mason, at least, to have second thoughts. "I think it's so easy to have a huge payout and lose half to tax and the other half to frauds and con men," he says. "So I'm not sure about it at all. I think it was an interesting idea, but I’m not sure it's the way to go."

Though mates Crosby, Stills and Young have sold, Graham Nash remains a hold out — "unless somebody makes me an offer I can't refuse."

And Creed/Alter Bridge co-founder Mark Tremonti says he's been listening to offers — including one negotiation that stopped when the company paid out large to another artists — he's comfortable biding his time before pulling the trigger.

"We've kept an eye on what's going on; we just haven't come across the right deal," he says. "Right now I really don't want to have any deals that would keep me from doing whatever I'd want to do with this music. It would have to be a huge deal for that to happen. So it's not something that's at the top of my agenda. If I want to work less and just relax more as I get older, that'll be the time to look at deals."

What's legacy got to do with it?

Most artists who are selling claim that they are concerned with who ends up with their rights and what they plan to do with it. Wendy Dio acknowledges that her late husband would probably never have sold his rights but says she shopped around before settling with Round Hill because "they're gonna continue pushing it, putting it out there, putting it in places and continue marketing it, long after I'm going, and it keeps Ronnie's music relevant and alive."

Motley Crue, meanwhile, went with BMG during 2021 because of the company's commitment to product as well as licensing, including box sets and anniversary campaigns — such as 2023's planned Year of the Devil campaign to commemorate the 40th anniversary of Crue's sophomore album, Shout at the Devil.

"BMG is great with these types of catalogs, and their team was really passionate about (Motley Crue's)," Chris Nilsson, president of 10th St. Entertainment, which manages Crue, told Billboard earlier this year. "People don't want just the vinyl anymore that's been available for years. They want the vinyl AND its prepackage with an exclusive T-shirt and a signed lithograph collector's item. I think there are a lot of opportunities for this band to participate in that marketplace, and BMG comes along with lot of expertise and ability to do things that were really attractive to (the band)."

BMG's Scherer, meanwhile, says he's surprised when he sees artists selling their catalogs to companies "where there is no music infrastructure...to take care of their legacy, of their kids, of the songs and music they've written. I think you want to make sure somebody's really taking care of it."

Cain adds that Journey has already seen benefits of its sale when Hipgnosis placed the band's 1983 hit "Separate Ways (Worlds Apart)" with the TV series Stranger Things, exposing a younger audience to the band and its catalog. "The fact is our albums don't sell like they used to," he says, "so it makes it very attractive to put (the music) with a company that understands the music and can do things with it and get it out there in ways we might not have access to otherwise."

A Brief History of Recorded Music Formats

BONUS: Weird + Wonderful One-Off Music Formats

More From Classic Rock 105.1